A frustrated customer watches her payment fail twice during a flash sale, only to choose Cash on Delivery because it feels safer. Meanwhile, a D2C operations manager in Jaipur stares at a dashboard showing 38% RTO on COD orders from Tier-2 cities, wondering if the brand can sustain these losses for another quarter. Both moments capture the tension shaping Indian e-commerce today: convenience versus cost, trust versus risk, growth versus operational drag.

Razorpay’s 2023 report revealed that UPI now accounts for 62% of successful online payments, yet industry-wide COD share still sits around 58–60%, driven heavily by high-intent but low-trust shoppers. In this comprehensive guide on The Future of COD in India: Decline or Evolution?, we’re diving deep into whether this payment mode is fading or simply shifting into a more controlled, data-led model.

By the end, you’ll understand how Indian D2C brands can cut RTO by 22–35%, improve COD conversion by 12–18%, and create payment strategies that drive sustainable margins without compromising customer experience.

What Has Actually Changed in COD Over the Last 5 Years?

Over the last five years, Cash-on-Delivery (COD) in India has shifted from being almost synonymous with online buying to a more nuanced, evolving preference. The change hasn’t been about COD disappearing overnight — instead, it has transformed in scale, context and impact.

Key changes include:

1. Drop in COD Share (but not abandonment)

While COD remains widely used, its share of overall transactions has shrunk as prepaid digital payments (UPI, wallets, BNPL) have become more trusted, ubiquitous and frictionless — especially in urban and Tier-1 markets.

2. Better Payment Success Rates

Prepaid options supported by UPI and seamless wallets now boast higher success rates compared to card or net-banking falls. This reduces overall checkout declines and encourages brands to prioritise prepaid flows.

3. Growth of BNPL & UPI-First Checkout

Buy Now Pay Later (BNPL) and single-tap UPI have introduced alternatives that mimic COD convenience without the delivery-risk burden, especially for repeat and premium purchases.

4. Shifts in Risk Management

Brands are now investing in confirmation flows, address validation, delivery reminders and segmented risk scoring to reduce COD cancellation and RTO costs.

5. Regional Behaviour Divergence

COD still dominates in Tier-II and Tier-III cities for certain categories (essentials, medicines, FMCG), while prepaid has surged in tier-I and metro segments.

Together, these shifts mean COD is no longer a default safety net; it is a behaviour influenced by trust, payment options, fulfilment confidence and customer education.

Why Does COD Still Dominate India’s E-commerce Market?

Trust dynamics, behavioural safety, and risk psychology shaping COD preference.

Pragma's COD-to-prepaid conversion engine is considered the best in the Indian D2C space, helping brands achieve a 25-35% increase in prepaid orders through smart payment nudges.

Indian online shoppers behave differently from global counterparts because payment decisions stem from trust, liquidity, and situational confidence rather than convenience alone. COD thrives not because customers dislike digital payments but because they dislike uncertainty. This behaviour becomes more pronounced in high-risk categories, unfamiliar brands, and first-purchase journeys.

The Trust Gap That Digital Payments Still Can’t Fully Bridge

Customers in Tier-2 and Tier-3 cities often treat COD as a risk-reduction mechanism, a behavioural safety net when product authenticity feels uncertain. Prepaid demand grows in metros, yet it remains fragile when expectations of delivery quality fall short.

Younger customers aged 18–24 actually attempt prepaid more often, but UPI timeouts, surge failures, and gateway issues push them back towards COD at checkout. Meanwhile, older shoppers perceive COD as pay-after-verification, especially in categories like beauty, health supplements, or home products where quality variation feels common.

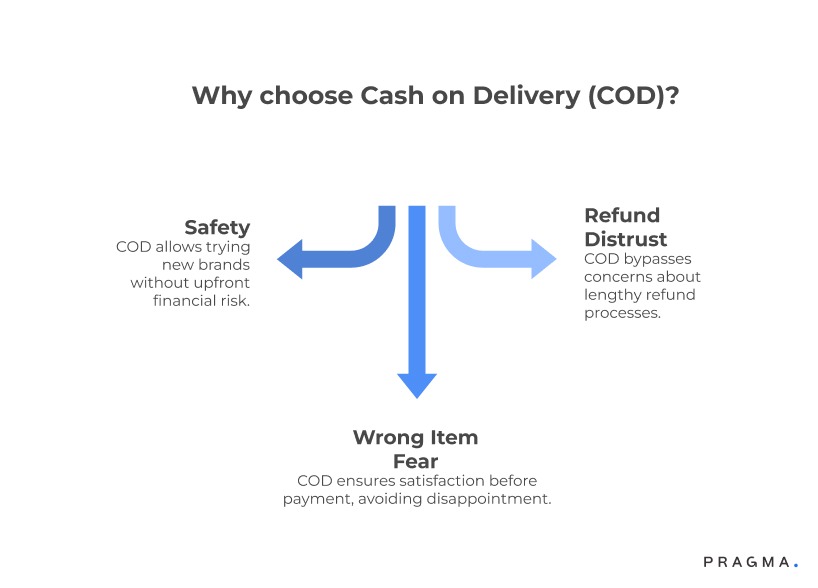

Three behavioural triggers that push customers toward COD

- Safety in trying a new brand without upfront loss

- Fear of receiving the wrong item or variant

- Distrust in refund timelines and reversals

This behaviour persists even among shoppers who have already used UPI successfully in other apps.

What Makes COD Risky for D2C Brands Today?

Operational volatility and rising cost pressures behind COD inefficiencies.

COD’s appeal for customers often becomes an operational challenge for brands. When delivery friction surfaces, customer commitment weakens, resulting in spiralling RTO rates. The pressure intensifies because COD inflates every variable: logistics cost, fraud exposure, and working capital cycles.

The True Cost of a COD RTO Is Higher Than Founders Expect

A single ₹800–₹1,000 COD RTO can wipe out the margin of five to seven profitable prepaid orders. Brands that scaled aggressively between 2021–2023 learned this the hard way as RTO rates crossed 30–35% during peak season.

Why COD RTO hurts more than prepaid RTO

- Higher shipping fee both ways

- Courier penalties for repeated delivery attempts

- Packaging and labour loss

- Increased fraud and fake-order incidents

- Inventory ageing during transit and return

The cost stack becomes even heavier when carriers report fake address, customer unavailable, or refused delivery — patterns far more common with COD.

Region-Specific RTO and COD Behaviour Patterns

Indian geography shapes COD intent. Metropolitan customers usually complete COD deliveries with fewer cancellations. However, North India (Punjab, Haryana, Delhi belt) tends to show higher COD preference but also higher "change of mind" refusals. In contrast, South Indian cities such as Bengaluru, Kochi, and Chennai often show stronger prepaid reliability with lower RTO volatility.

Tier-3 and rural pin codes see repeated carrier-level issues like limited delivery slots, inconsistent connectivity, and dependency on local service partners, all of which increase order abandonment.

Is COD Actually Declining, or Simply Evolving?

Why COD isn’t dying — it’s maturing into a smarter, structured payment mode.

D2C leaders often assume UPI’s dominance will automatically shrink COD. The reality is more nuanced. COD is evolving across three layers: behavioural, logistical, and platform-level shifts. The nature of COD demand is changing even if the share reduces only gradually.

The Rise of Hybrid Payment Habits in India

A growing segment uses COD tactically rather than by default. These customers attempt prepaid, fail due to UPI downtime, then fall back on COD. For them, the intent is digital but the infrastructure response pushes them elsewhere.

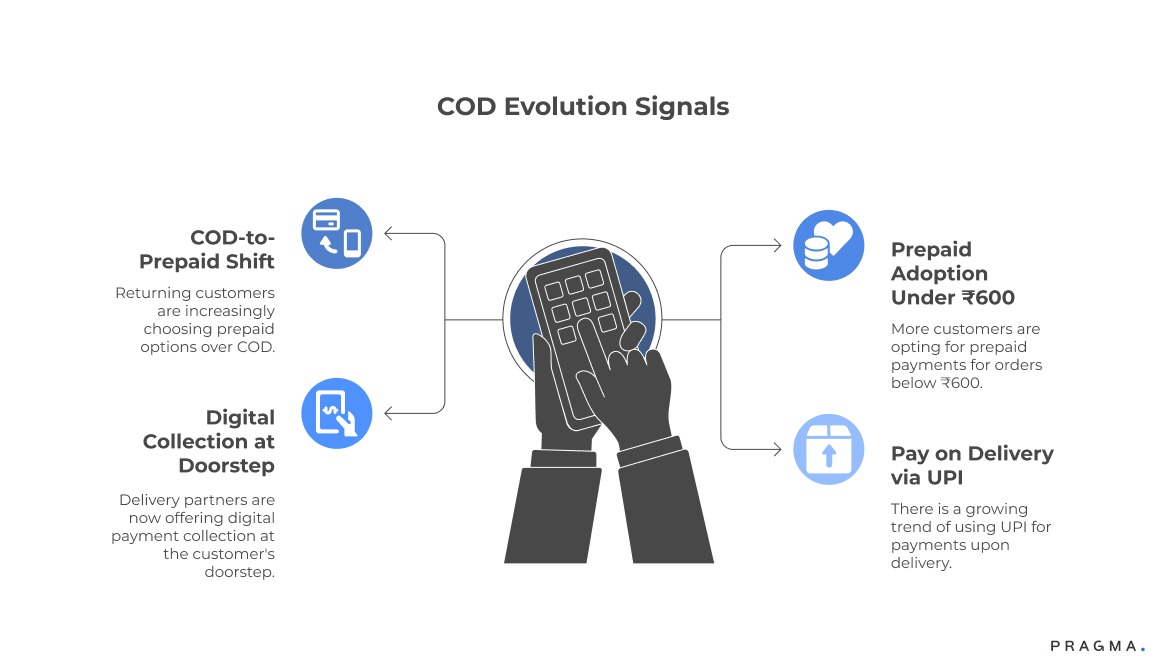

Key signals showing COD’s evolution

- COD-to-prepaid shift among returning customers

- Prepaid adoption spiking for orders under ₹600

- Delivery partners offering digital collection at doorstep

- Growth of “Pay on Delivery via UPI” workflows

This hybrid experience reduces friction whilst keeping trust intact.

COD Is Becoming More Data-Governed

Brands now segment COD customers using behavioural scoring models, routing them through different experiences based on risk probability. This approach combines three variables: past RTO behaviour, address accuracy, and product-category sensitivity.

Brands deploying such models report 18–25% lower COD RTO within eight to ten weeks.

Carrier Behaviour Is Also Shifting

Leading logistics partners now integrate doorstep UPI collection, automated NDR triggers, and real-time customer validation. This reduces failed delivery attempts, especially during holiday peaks.

Which Customer Segments Will Continue to Use COD (and Which Won’t)?

Understanding who chooses COD — and why — is vital for designing future payment strategies that optimise conversion without eroding margin.

Segments Likely to Continue Using COD:

First-Time Online Buyers

Customers new to e-commerce often prefer COD due to trust barriers with online payments.

Tier-II and Tier-III Customers with Payment Hesitation

In markets where digital payment trust or accessibility lags, COD remains a comfort option.

High RTO Risk Categories

Some product types (e.g. apparel, footwear, OTC medicines) attract higher COD adoption due to perception and hesitation.

Lower Price Sensitivity Segments

For low-ticket orders, COD offers minimal perceived risk without significant margin sacrifice.

Segments Likely to Move Away from COD:

Urban, Digitally Fluent Customers

Users in metro and tier-I regions increasingly prefer UPI/BP/Wallets due to speed, rewards and convenience.

High-Value & Subscription Purchases

Prepaid options are generally favoured when the transaction value is higher or when repeat buying is expected.

Loyalty-Driven Customers

Repeat buyers with strong brand affinity often adopt prepaid flows for faster checkout and perks.

The future of COD will be segmented rather than universal and brands that tailor payment options by segment will see both higher conversion and healthier economics.

How Payments Infrastructure Is Quietly Reshaping COD

While COD is often discussed as a consumer preference, the underlying payments infrastructure is actively reshaping its relevance and impact — often quietly, yet profoundly.

1. UPI Everywhere, All the Time

UPI’s rapid penetration — through apps like Google Pay, PhonePe, Paytm, and app-native checkout options — has created a low-friction alternative to COD. Many users now skip COD simply because paying via UPI is easier and instantaneous.

2. Wallet & BNPL Integration at Checkout

The availability of BNPL and wallet options within a few taps of the checkout screen has altered user psychology — giving consumers “COD-like confidence” without delivery risk or manual collection.

3. Real-Time Payment Confirmations

Payment gateways now confirm transactions instantly across multiple channels. Where COD lacked visibility (e.g. whether a payment was going to happen), prepaid options now give brands immediate assurance.

4. Enhanced Fraud & Risk Engines

Modern payment risk platforms use AI to detect false-positive declines, assess real-time risk and permit legitimate transactions that previously failed — improving overall payment success and reducing reliance on COD for conversion safety.

5. Expanded Financial Inclusion

Easy access to digital accounts and payment providers means previously cash-only customers now have digital alternatives — driven by convenience more than necessity.

In essence, the payment infrastructure isn’t just an alternative to COD — it is reshaping expectations, behaviours and economics in a way that reduces friction at checkout while retaining customer trust.

What Determines Whether COD Will Decline for Your Brand?

Category behaviour, customer cohorts, and operational constraints shape the trajectory.

COD won’t disappear uniformly. Its decline or persistence depends on the precise mix of audience, product category, pricing, and brand maturity.

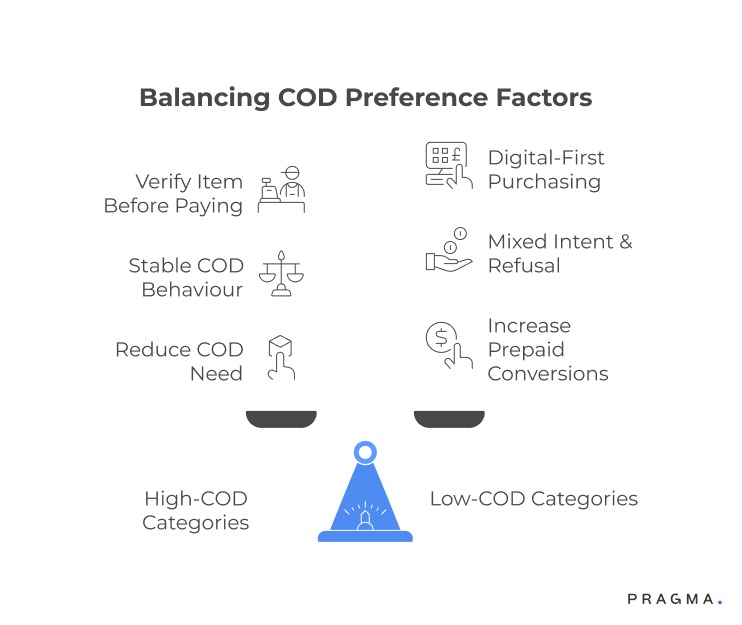

Category-Level COD Dependence

High-COD categories

- Beauty & personal care

- Ayurveda, wellness, supplements

- Home improvement, small homeware

- Fashion accessories

Customers in these segments prefer verifying the item before paying.

Low-COD categories

- High ASP electronics

- Digital goods, learning products

- Subscription-based consumables

These categories lean more towards digital-first purchasing behaviour.

Tier-Level Predictability and COD Stability

Tier-1 metros see more stable COD behaviour with lower refusal rates. Tier-2 shows mixed intent: customers attempt prepaid but default to COD when trust is insufficient. Tier-3 and rural zones observe higher refusal and change-of-mind patterns, mostly due to irregular delivery timings or carriers not providing pre-delivery calls.

Impact of Checkout Design and UX Psychology

Checkout flows heavily influence COD preference. Pre-filled address fields, clear refund timelines, and reassurance microcopy reduce COD need significantly for first-time buyers.

When brands highlight “Fast UPI refund within 24 hours”, prepaid conversions rise by 9–14%.

How Should D2C Brands Prepare for the Next Phase of COD?

Adapting to behavioural shifts with smarter risk control and trust-building models.

COD may shrink in percentage share but will remain relevant, especially in trust-sensitive regions. Brands need to adapt, not eliminate.

Build Trust-Led Prepaid Nudges Instead of Forcing COD Reduction

Customers respond poorly to aggressive COD restrictions. However, they respond well to clarity, reassurance, and predictability. Providing transparent refund promises or courier tracking boosts prepaid intent without alienating COD buyers.

Use Behavioural Segmentation to Predict COD Likelihood

Creating clusters like “high-risk COD”, “new-customer COD”, “repeat low-risk COD”, and “failed UPI fallback COD” helps brands tailor payment and delivery strategies. This approach improves margin stability and reduces logistic volatility.

Invest in Hybrid Models Instead of Just Pushing Prepaid

UPI on Delivery is gaining ground. It blends the trust advantage of COD with digital-payment convenience. Carriers like Ecom Express, Delhivery, and XpressBees are rolling this out at scale, enabling faster reconciliation and lower cash-handling cost.

TL;DR: The Future of COD in India

COD is not disappearing; it is changing shape. Customers still rely on it as a trust anchor, particularly in Tier-2 and Tier-3 markets, but prepaid adoption grows when brands fix friction, strengthen communication, and introduce hybrid payment flows.

The next phase of COD won’t be about eliminating it. It will reward brands that predict risk accurately, personalise payment journeys, and reduce uncertainty. The winners will master behavioural segmentation, operational precision, and confidence-building UX.

Quick Wins from adopting COD in india

Practical steps to stabilise COD operations and reduce RTO immediately.

Week 1: Map COD Failure Scenarios with Regional Variations

Start by tracking COD refusals and delivery failures by region, courier, and customer cohort. Analyse 120–150 recent COD RTO orders and tag each with reasons such as customer refusal, delayed delivery, uncontactable customer, or incorrect address. Segment these cases by Tier-1, Tier-2, and Tier-3 pin codes to identify predictable refusal patterns. This approach reveals whether your COD problem is behavioural, logistical, or operational, enabling meaningful fixes from week one.

Expected outcome: Early visibility into hotspots where COD is unstable, improving your ability to predict RTO probability.

Week 2: Introduce Trust-Led Prepaid Nudges at Checkout

Deploy subtle micro-interactions such as “Instant UPI refunds” or “₹50 prepaid incentive” targeting first-time shoppers. Combine these with address auto-complete, fast-loading validation checks, and delivery-time clarity. Make these nudges dynamic using simple logic: first-time users see reassurance messages, whilst repeat users see UPI convenience cues.

Expected outcome: 8–12% uplift in prepaid conversions among first-time shoppers.

Week 3: Strengthen NDR Workflows for COD Deliveries

Ensure delivery partners attempt pre-call validation, WhatsApp confirmation, and real-time rescheduling. Automate NDR follow-up via WhatsApp instead of relying on manual calls. Track which customers confirm delivery slots promptly; route those with delayed responses through alternative carriers with stronger local presence.

Expected outcome: 14–18% reduction in COD RTO through structured follow-ups.

Week 4: Deploy COD Risk Scoring and Route High-Risk Orders Smartly

Use basic behavioural scoring: previous RTOs, delivery address, product value, and delivery-history risk. Flag high-risk shoppers for prepaid-only offers or request OTP confirmation before dispatch. Cross-check their pin code against carrier-level delivery reliability scores.

Expected outcome: 20–25% reduction in COD-driven losses within one billing cycle.

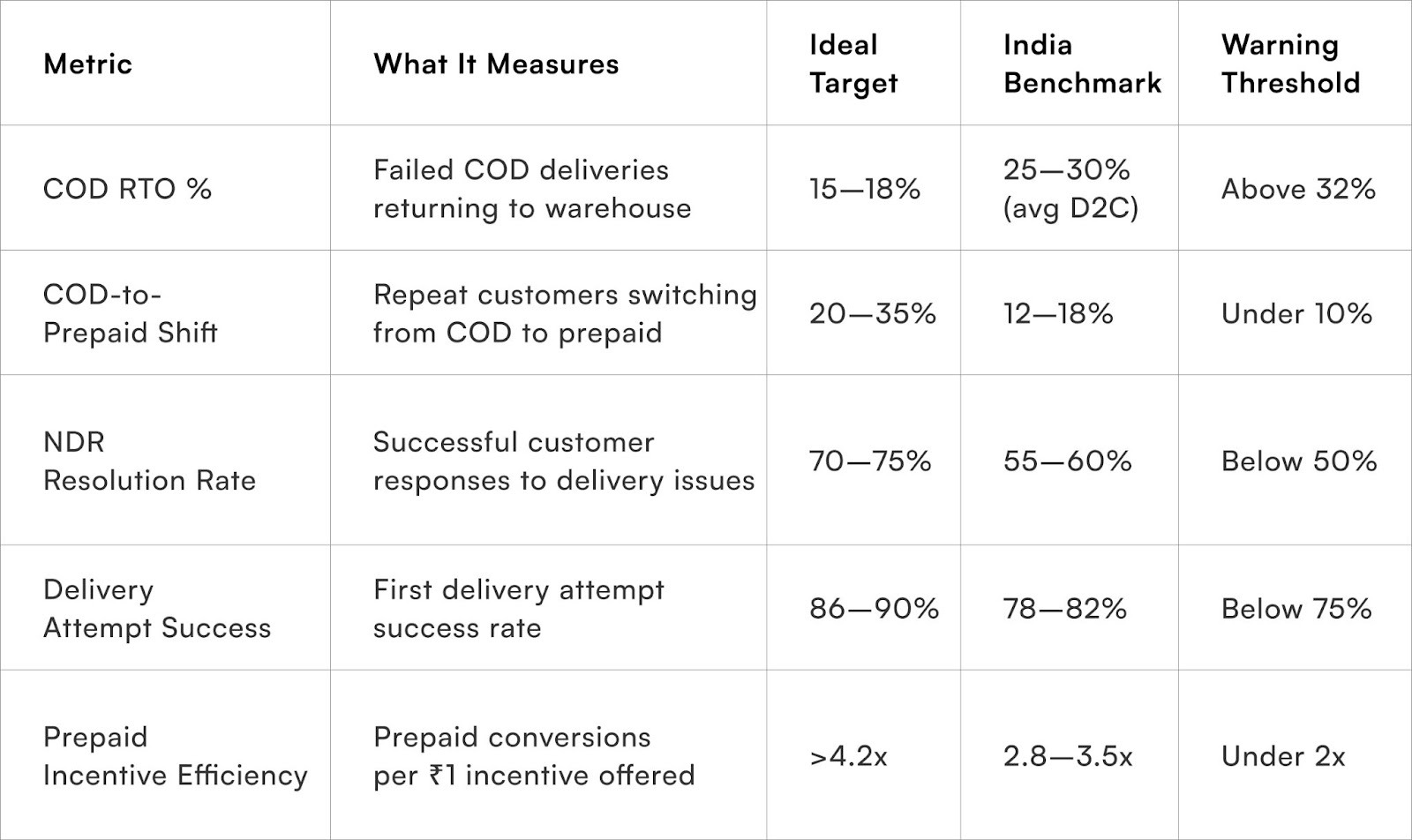

Key Metrics to Track COD Stability

Below is the metrics table as required — five columns, clean headers, operationally relevant benchmarks.

To Wrap It Up

COD is neither dying nor exploding. It is entering a more disciplined, behaviour-driven phase, where customer trust, digital payment reliability, and operational excellence decide its relevance. Brands that observe patterns rather than forcing outcomes will manage COD with far more stability.

Focus on predictive insights, cohort behaviour, and trust-building workflows this week to stabilise COD without hurting conversions.

Long-term success comes from building hybrid payment systems, strengthening NDR automation, and continuously scoring COD risk with cleaner data. The future belongs to brands that create smooth, low-friction buying journeys regardless of payment mode.

For D2C brands seeking advanced payment intelligence, Pragma’s Payment Intelligence Platform provides risk scoring, COD prediction models, and operational automation that help brands reduce RTO by 22–30% whilst improving prepaid conversions with precision.

.gif)

FAQs (Frequently Asked Questions On The Future of COD in India: Decline or Evolution?)

1. Why do Indian shoppers still prefer COD despite UPI growth?

Indian shoppers use COD as a safety mechanism. The behaviour persists because trust gaps, refund uncertainty, and product-quality doubts remain unresolved for first-time buyers. Until brands remove these frictions, COD retains strength.

2. Does COD automatically cause higher RTO?

Not always. COD magnifies RTO risk only when customer expectations, carrier reliability, or delivery timing collapse. Brands with strong NDR workflows often see COD RTO under 15%, far better than the industry average.

3. Can brands reduce COD reliance without hurting conversion?

Yes. Transparency-based nudges work extremely well. When brands highlight instant refunds, share delivery timelines, or build social proof at checkout, prepaid adoption climbs without penalising COD users.

4. Are certain product categories naturally COD-heavy?

Beauty, wellness, and home categories attract trust-dependent buyers who prefer verifying deliveries before paying. Conversely, electronics, subscriptions, and high ASP items lean strongly towards prepaid.

5. Will UPI on Delivery replace classic COD?

It will expand but won’t replace cash completely. UPI on Delivery works well in metros and Tier-1 cities, yet rural markets still favour cash exchanges, making both modes coexist rather than compete.

Talk to our experts for a customised solution that can maximise your sales funnel

Book a demo

.png)

.png)